Другие материалы рубрики «English»

-

Human rights groups condemn European Olympic Committees for “sportswashing” human rights abuses in Azerbaijan

Human rights groups condemn European Olympic Committees for “sportswashing” human rights abuses in Azerbaijan

The coalition also condemns EOC President Patrick Hickey for praising the Azerbaijani leader, Ilham Aliyev. -

Kobryn-based opposition activist Ales Mekh launches presidential bid

Kobryn-based opposition activist Ales Mekh launches presidential bid

Apart from Mr. Mekh, six persons have already announced their intention to run in this year’s presidential election...

- Quarter of adult Belarusians are smokers, official statisticians say

- Experts draw up media reform “roadmap” in framework of Reforum projec

- Leader of Belarusian Popular Front skeptical about new Nyaklyayew-led movement

- Authorities have no plans for liberalization, Belarusian Popular Front leader says

- Second session of pro-independence congress expected to be held in Minsk on June 7

- Rescuers stage massive exercise at sports center in Minsk

- Revelers in Minsk celebrate end of Butter Week

- Leaders of France, Germany, Russia, Ukraine arrive in Minsk for summit on Ukraine crisis

- United Kingdom’s Visa Application Center in Minsk moves into permanent office

- Minsk residents paying tribute to victims of Charlie Hebdo massacre in Paris

English

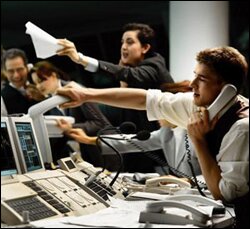

Belarus set to sell Eurobonds to Russian investors

Belarus plans to place Eurobonds in the Russian market soon, Pyotr Prakapovich, chairman of the National Bank of Belarus (NBB), told reporters in Minsk on Thursday, as quoted by BelaPAN.

"A decision has been made that Eurobonds will be placed in the Russian market in the near future, maybe in August, so that this market is also open to us, that we have a credit history and the experience of working with the Russian ruble," he said.

"A decision has been made that Eurobonds will be placed in the Russian market in the near future, maybe in August, so that this market is also open to us, that we have a credit history and the experience of working with the Russian ruble," he said.

Mr. Prakapovich predicted that Belarus would raise between $100 million and $200 million in the Eurobond offer in Russia. "This will be a trial placement. We need to sound out the Russian market's attitude toward our securities," he said.

The NBB chairman announced that Belarus would sell its Eurobonds in Asian countries either later this year or in early 2011. "The Asian market is one of the most efficient, including in terms of the cost of placing securities, their quantity. This is a big market and we need to tap it," he said.

Commenting on the recent sale of $600-million Eurobonds at 8.75 percent, Mr. Prakapovich described the placement as successful. "We placed a low amount," he said, adding that investors were ready to buy up to $1.6 billion worth of Belarus' Eurobonds.

He acknowledged that the yield of 8.75 percent offered to investors was fairly high. "This is our first placement of Eurobonds. Today we have no credit history, no one knows us," he said.

The NBB chairman expressed certainty that a lower yield would be offered to investors in the future.

Alyaksandr Lukashenka, by his May edict, allowed the Belarusian government to issue up to $2 billion worth of securities.

Standard & Poor's Ratings Services announced on July 26 that it had assigned its “B+” preliminary long-term senior unsecured debt rating to the proposed debut Eurobond to be issued by Belarus.

It said that the amount and interest rate, as well as other details of the bond would be determined during the replacement.

At the same time, Standard & Poor's assigned a recovery rating of “4” to the proposed bond.

“This is in line with our policy to provide our estimates of likely recovery of principle in the event of debt restructuring or a debt default for issuers with a speculative-grade rating,” the agency said in a statement. “A recovery rating of '4' indicates our expectation of a 30%-50% recovery in the event of a payment default. According to our criteria, bonds with a '4' recovery rating are rated on par with the issuer credit rating. The rating on Belarus' upcoming bond is therefore equalized with the 'B+' foreign currency sovereign credit rating.”

Standard & Poor's said that the ratings on Belarus are constrained by “its weak and deteriorating external liquidity, owing to very high current-account deficits and repeated price shocks on still-subsidized energy imports from Russia.”

В настоящее время комментариев к этому материалу нет.

Вы можете стать первым, разместив свой комментарий в форме слева